Rent increases are putting a big financial strain on many Australians. But a closer look at the data reveals which households are feeling the most pain.

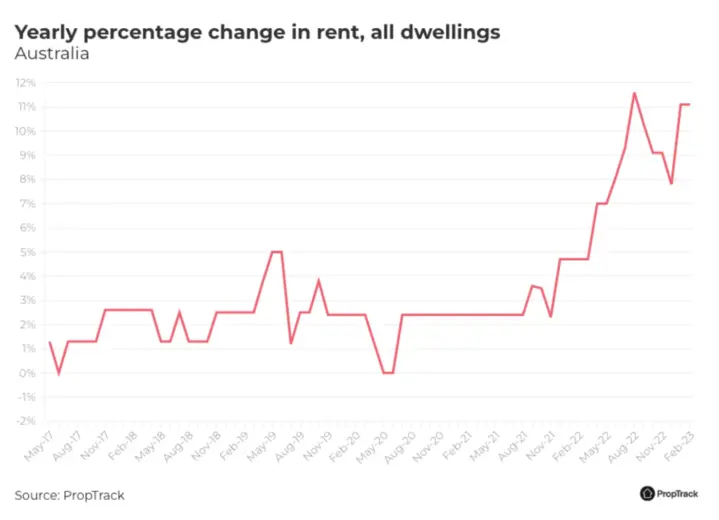

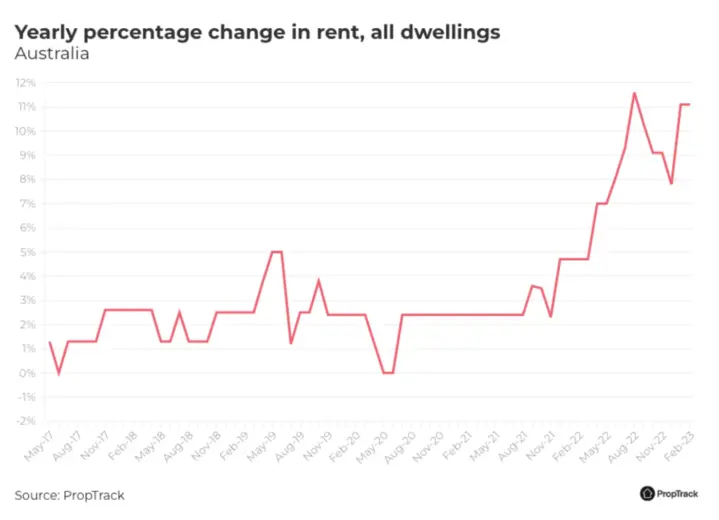

Over the past year, advertised rents have increased by 11% nationally. This has followed the strong demand for rental properties relative to the available supply.

The surge in rents comes at a time when tenants are already navigating broader cost-of-living pressures due to high inflation. Given renters make up a third of all households, a large portion of the Australian population will be under significant financial pressures in 2023.

The rental crisis is affecting many Australian households, particularly those under financial stress. Picture: Getty

However, some renters will be harder hit than others. The worst hit will be renters who are already vulnerable to financial stress as well as the renters who are experiencing higher-than-average increases in rents.

To investigate this, we looked at the data around which Australians spend the highest proportions of their incomes on rent and look at how rental increases have affected them based on where they live.

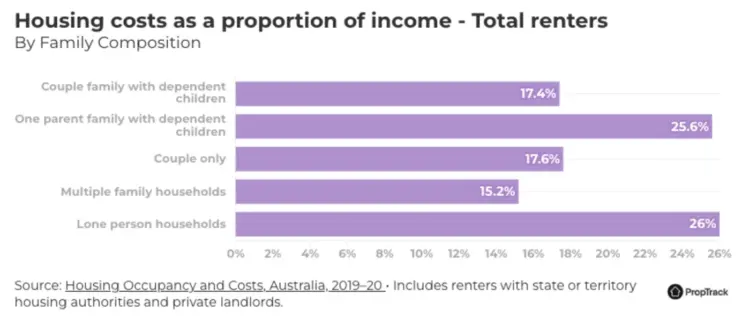

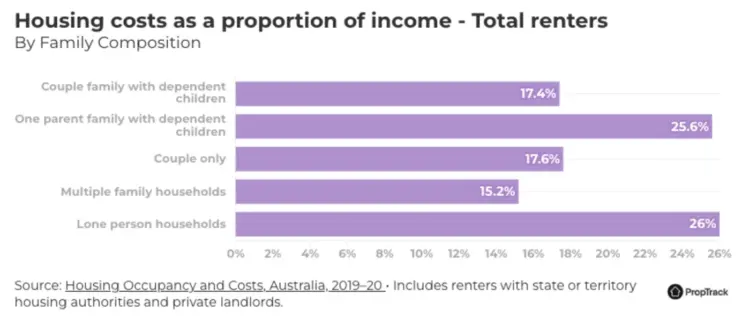

Single parents and single people are vulnerable to financial stress

Single parents and those living alone are the Australian family types who generally feel the most financial pressure.

Not only do they spend a larger proportion of their income on housing costs but they also have the lowest household incomes on average1.

These households spend over a quarter of their income on rent, on average, which is substantially higher than other family types.

With rents rising rapidly, generally far above wage increases, it will become increasingly difficult for single parents and lone-person households, as an even greater portion of their income will be needed to pay for housing costs.

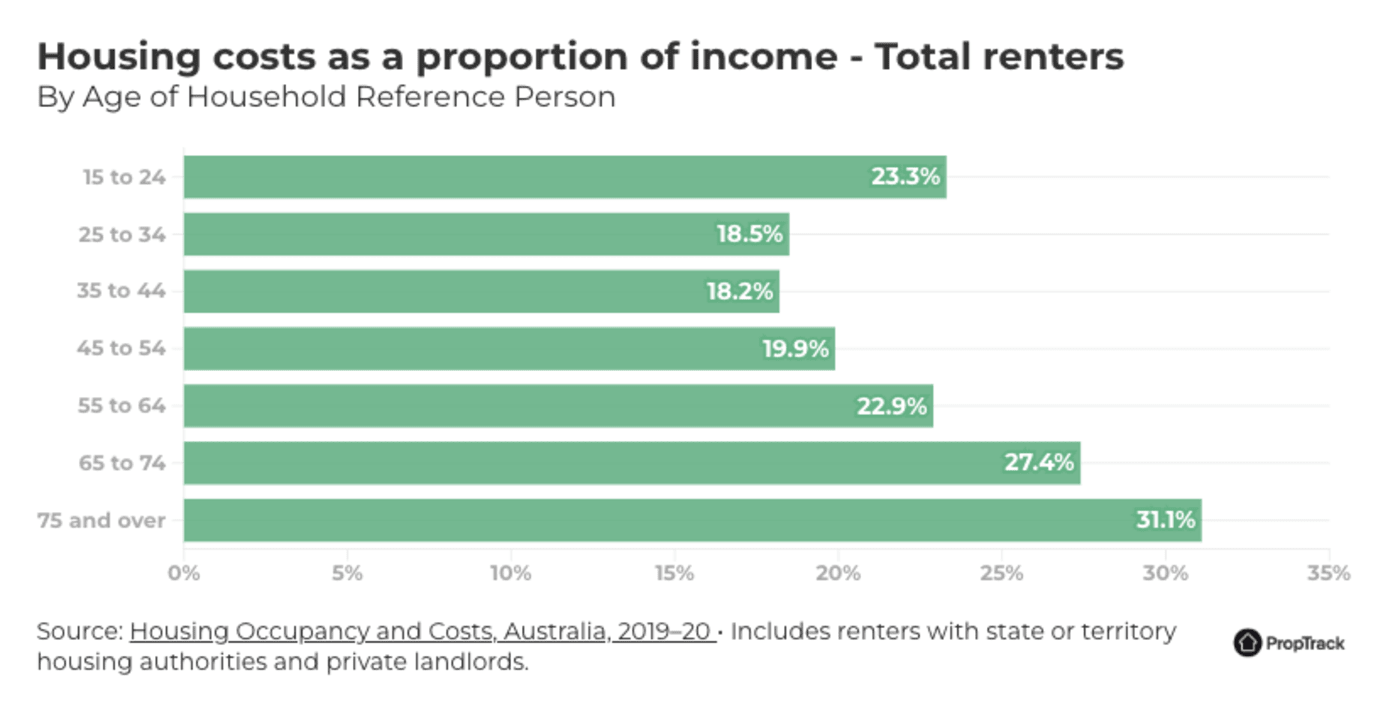

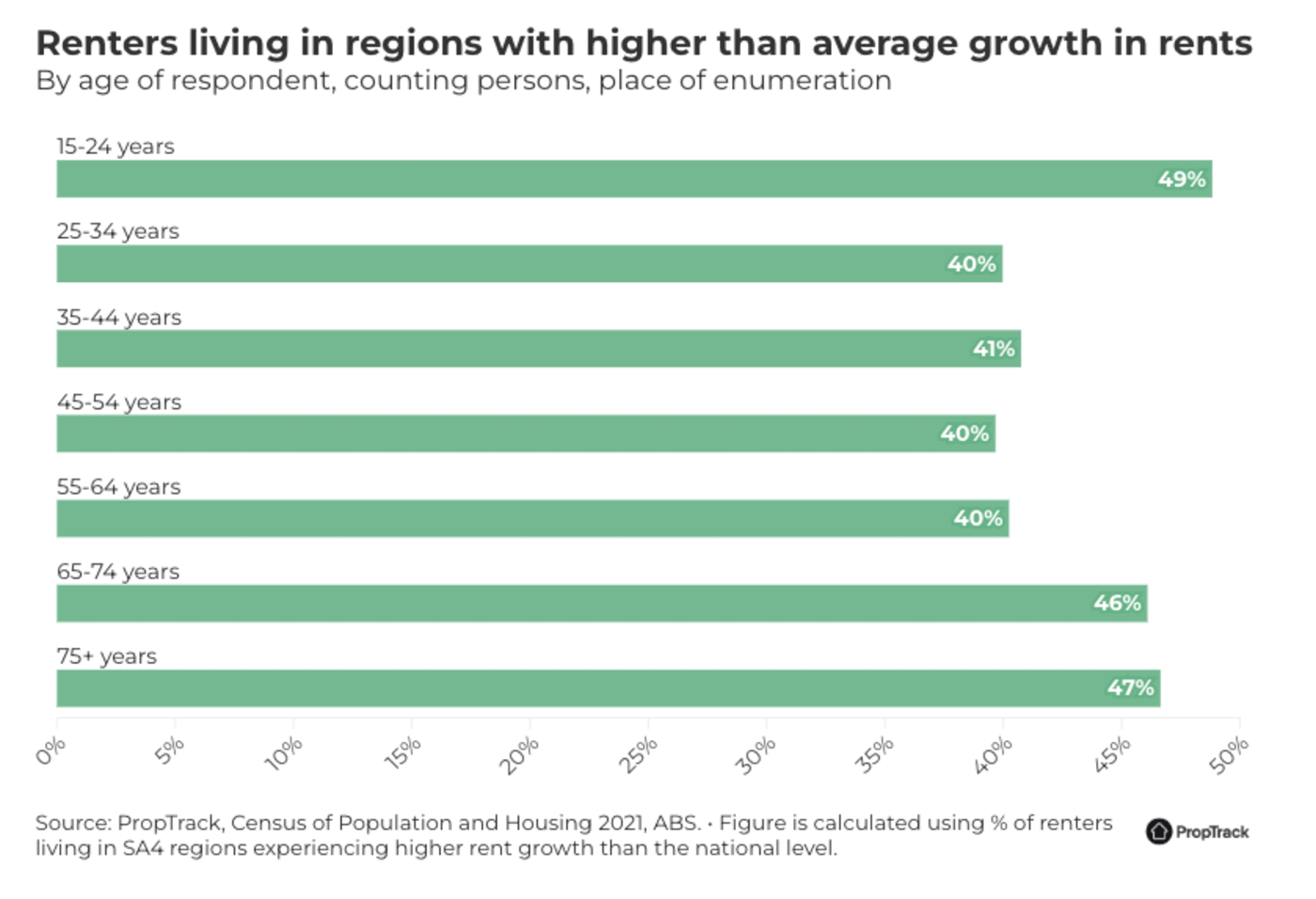

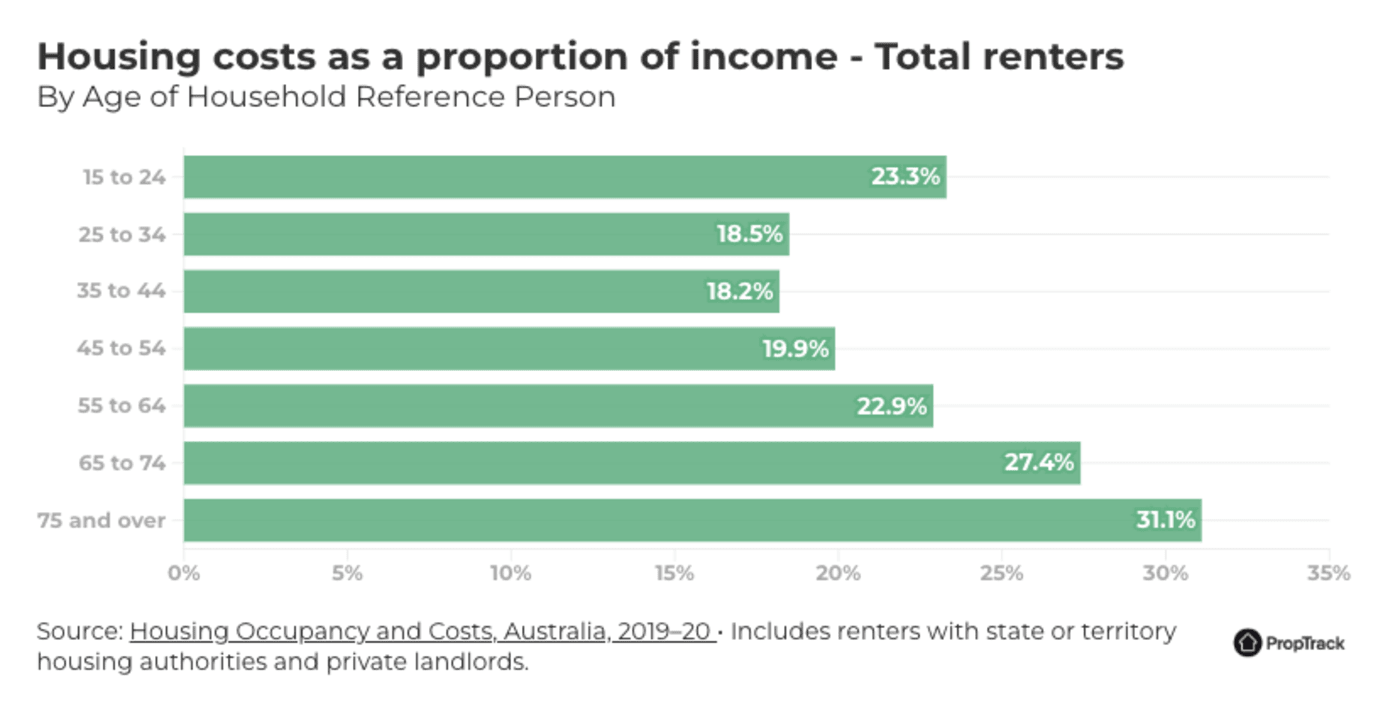

The youngest and oldest Australians will feel the rent pinch the most

Australians aged 15-24 years, often students, and those over 65 years who mostly are retired, tend to spend most of their incomes on rent.

They also have the lowest incomes.

Compared to middle-aged people (25-64 years), a larger proportion of people in these age groups make less than $1000 a week2.

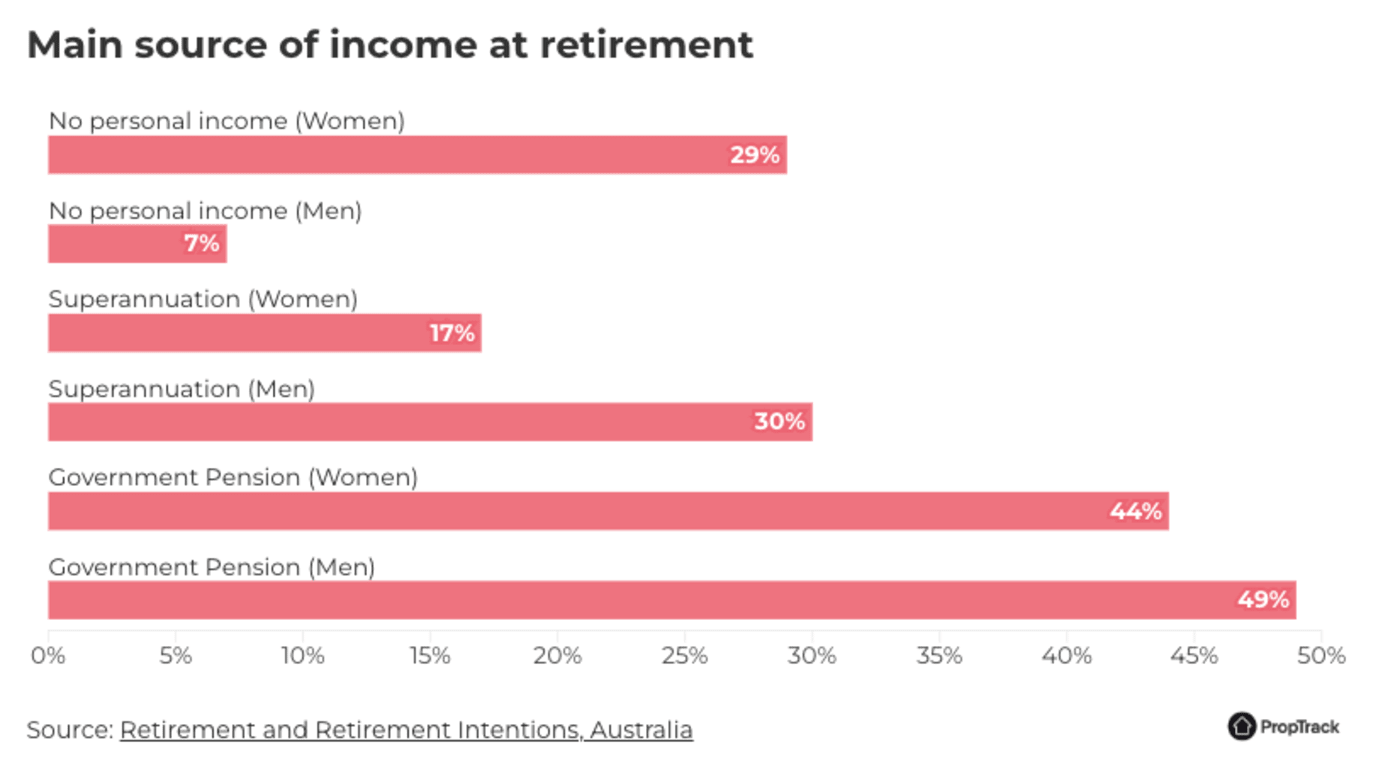

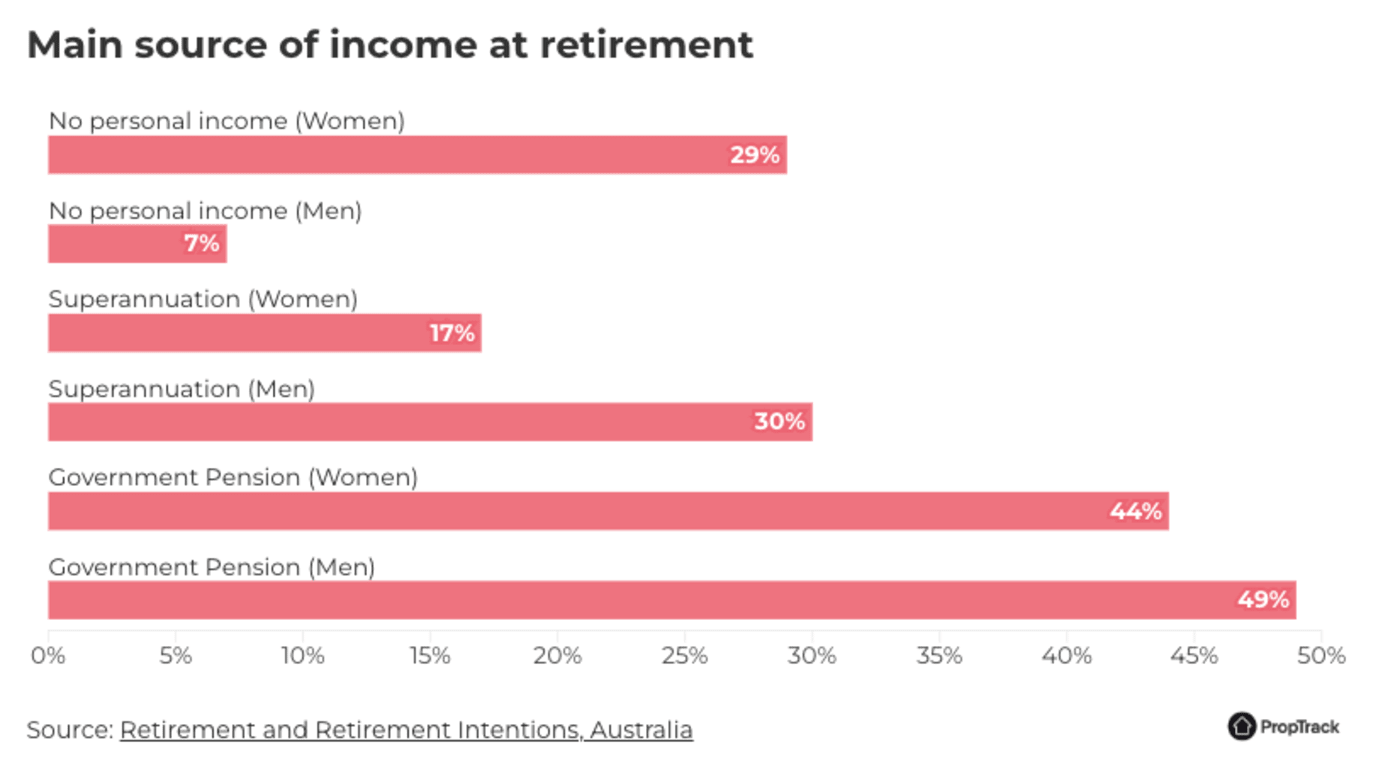

In addition to this, the main source of income for almost half of retirees is government pensions. Those who rely on these payments tend to experience high levels of financial stress3.

These factors mean younger and older Australians are more sensitive to rent increases, which undoubtedly puts them in a worse position in the current rental market.

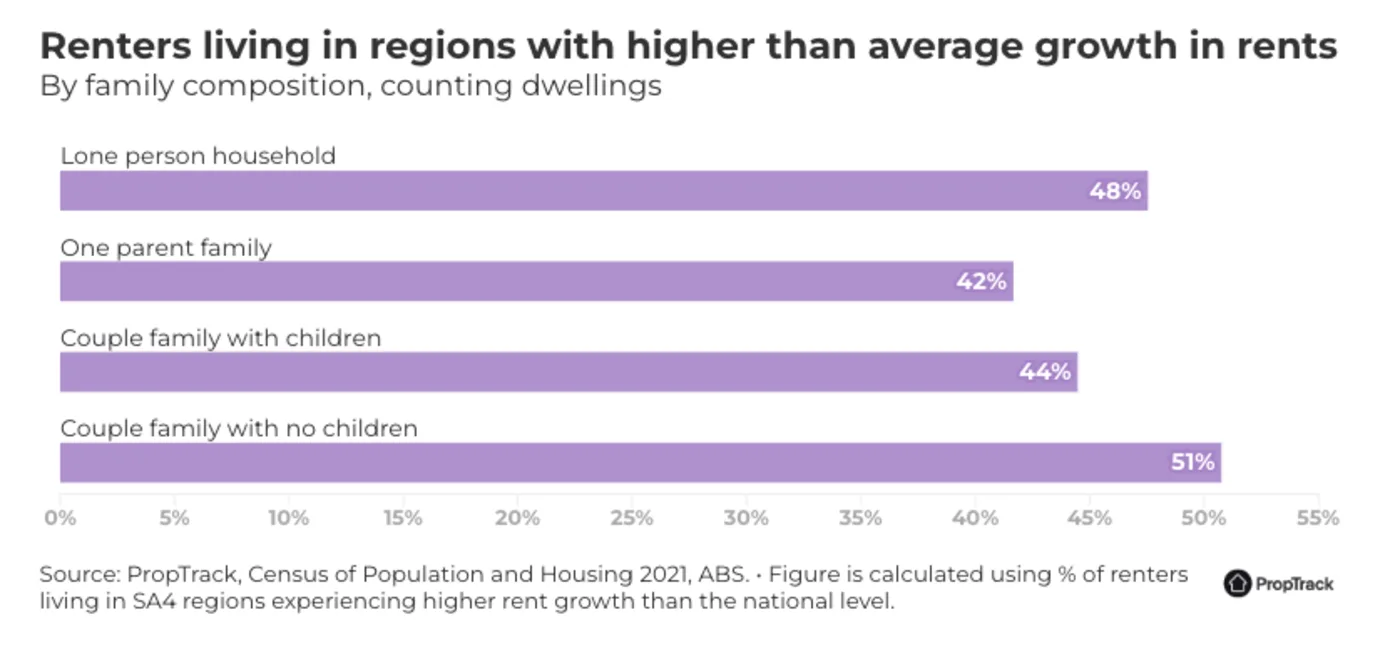

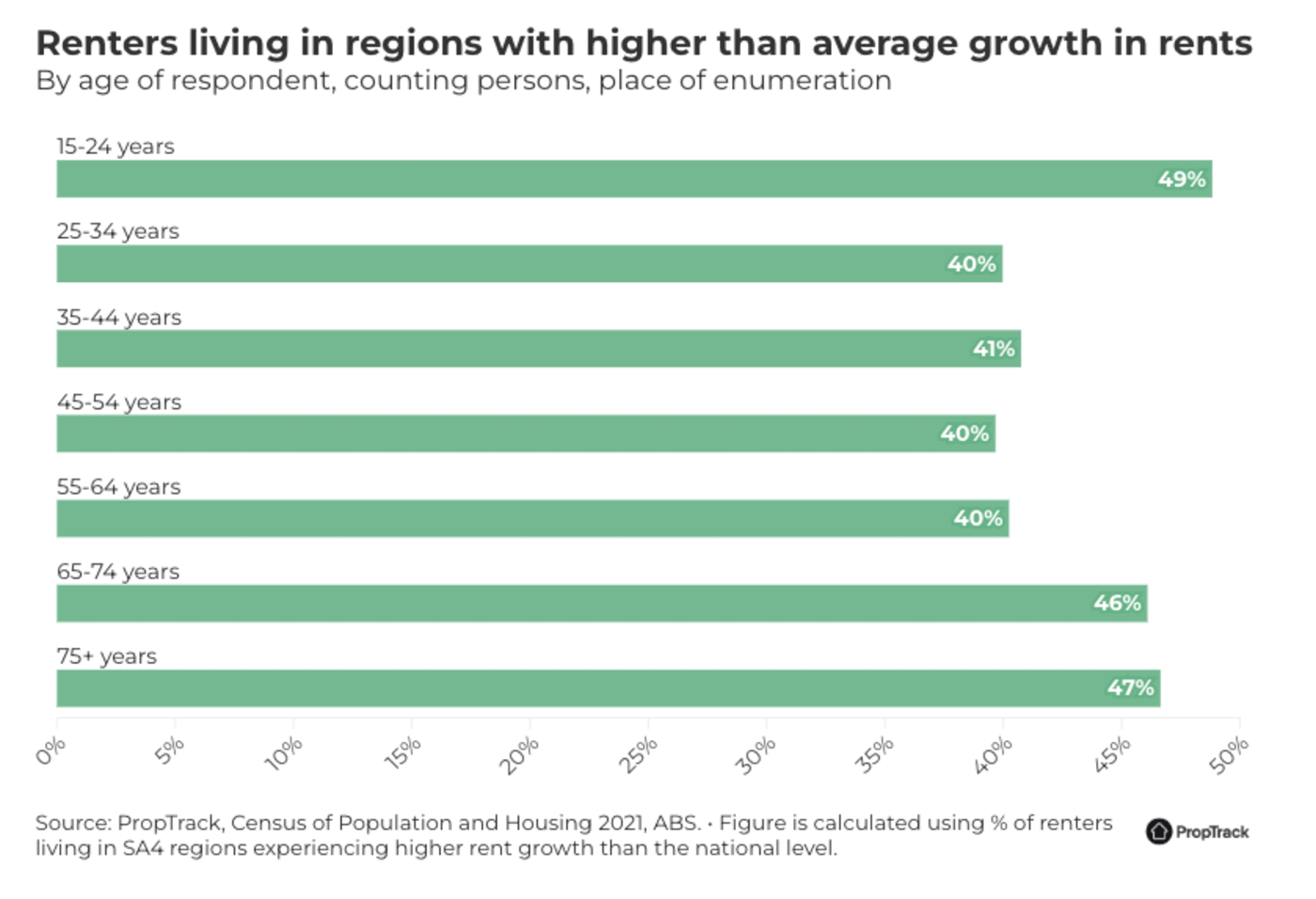

Rents are also increasing the most where vulnerable Australians live

Rent prices have increased rapidly across the country - but some regions have seen larger increases than others.

In particular, capital city areas have experienced strong rental growth over the past year following the return of workers to offices, the return of students to face-to-face learning and the reopening of borders.

This has a greater impact on the most vulnerable renters.

This is because some of these renters are more likely to live in regions where rent growth has been even higher than average.

Almost half of all lone-person renter households lived in regions that saw rents increase by more than 11% over the past year.

While this was a smaller proportion than couple families without children, the financial impact is likely to be worse for single people who are already spending a larger proportion of their income on housing costs.

It is a similar story for students and retirees.

Not only do these households contribute a larger share of their income towards rent but younger and older Australians are more likely than other age groups to reside in regions where weekly rents grew more than the national average.

This puts them in a particularly vulnerable position in the current rental crisis.

What comes next?

Strong rent growth is likely to persist this year. Demand remains extremely high in inner-city areas following the return to offices and universities, while supply shortages are unlikely to be resolved in the short term.

These tough market conditions will continue to put pressure on single-parent and single-person households, as well as younger and older Australians. These households already pay more of their incomes in rent and often live in regions where rents are growing even faster than average.

These financial pressures are likely to push more of these households into alternative arrangements – such as shared housing as people struggle to compete for available rentals.

To address the housing shortage and cater for our growing population, it is key that we focus on building more homes and encouraging investors to return to the market.

Learn more