April was a quieter month for the nation’s property markets amid the Easter and Anzac Day long weekends.

While April is typically a slower month for property markets around the nation, property market activity has been consistently slower this year than last.

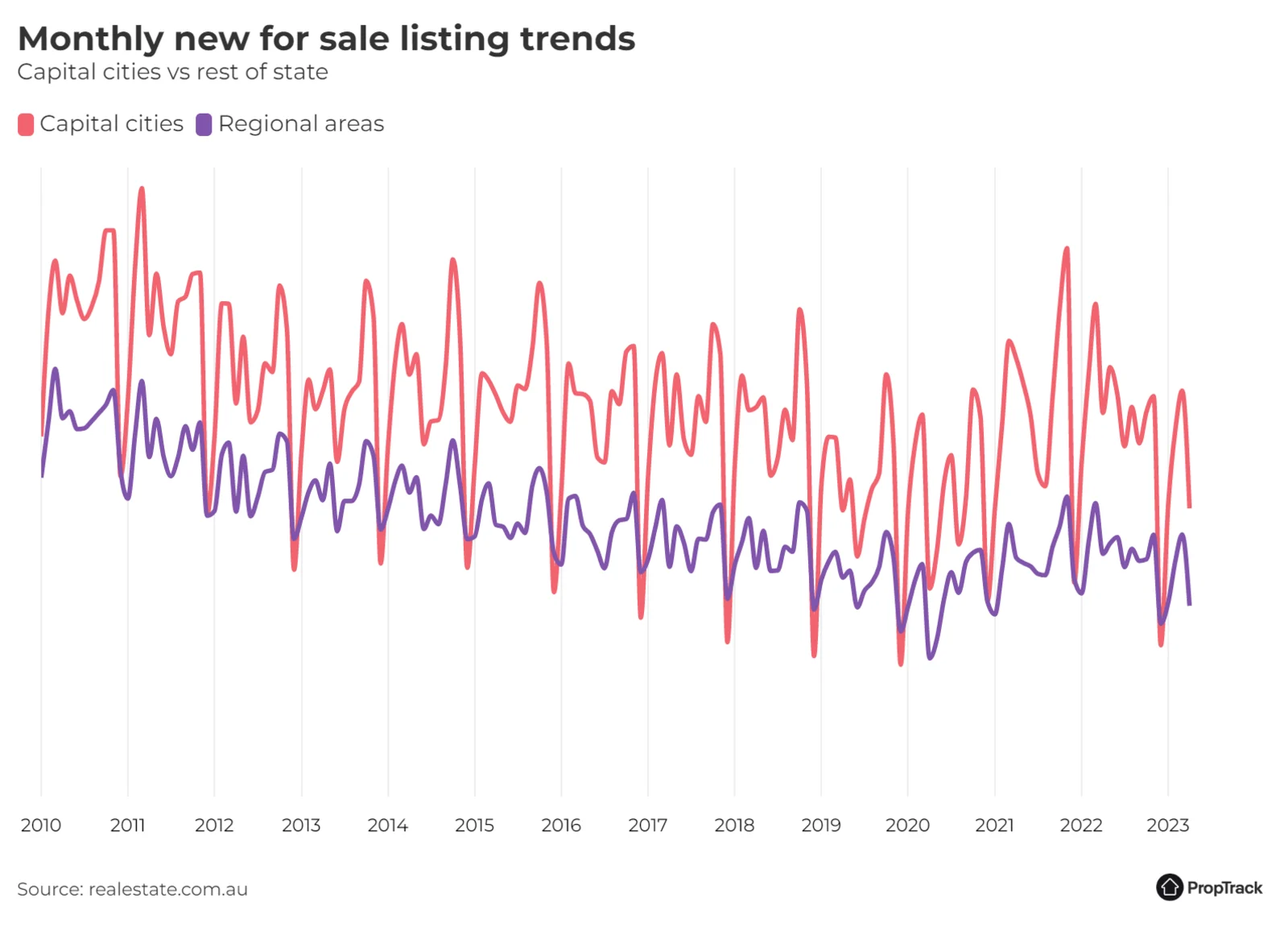

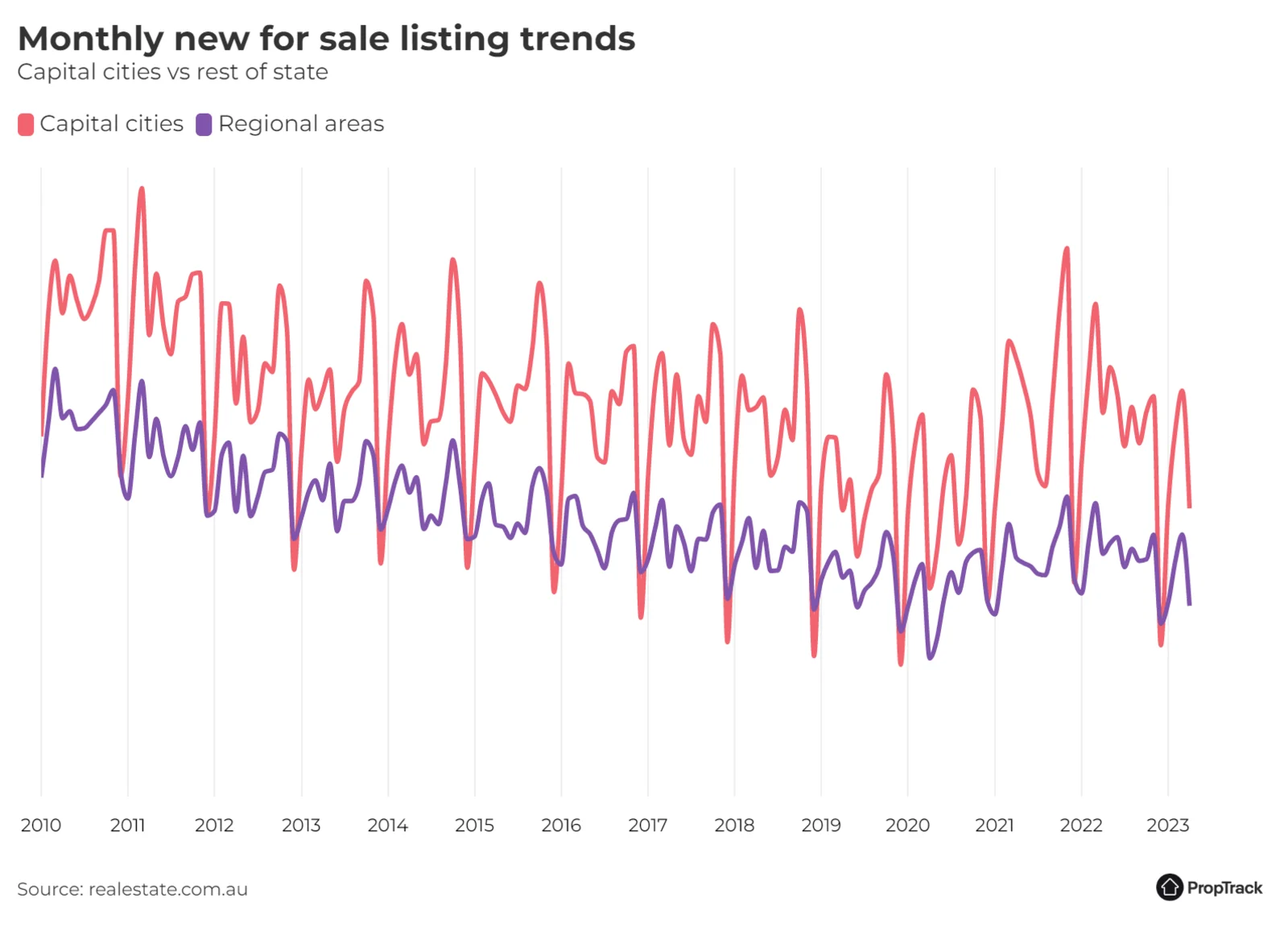

In part, that reflects just how busy property markets were during the early months of 2022 – the start of 2022 was the busiest first quarter of new listings since 2014. This year has not kept pace with that very busy mark.

Download the PropTrack Listings Report - April 2023

The total number of properties listed for sale in April was 5.6% higher than a year earlier, giving would-be buyers more choice. Picture: Getty

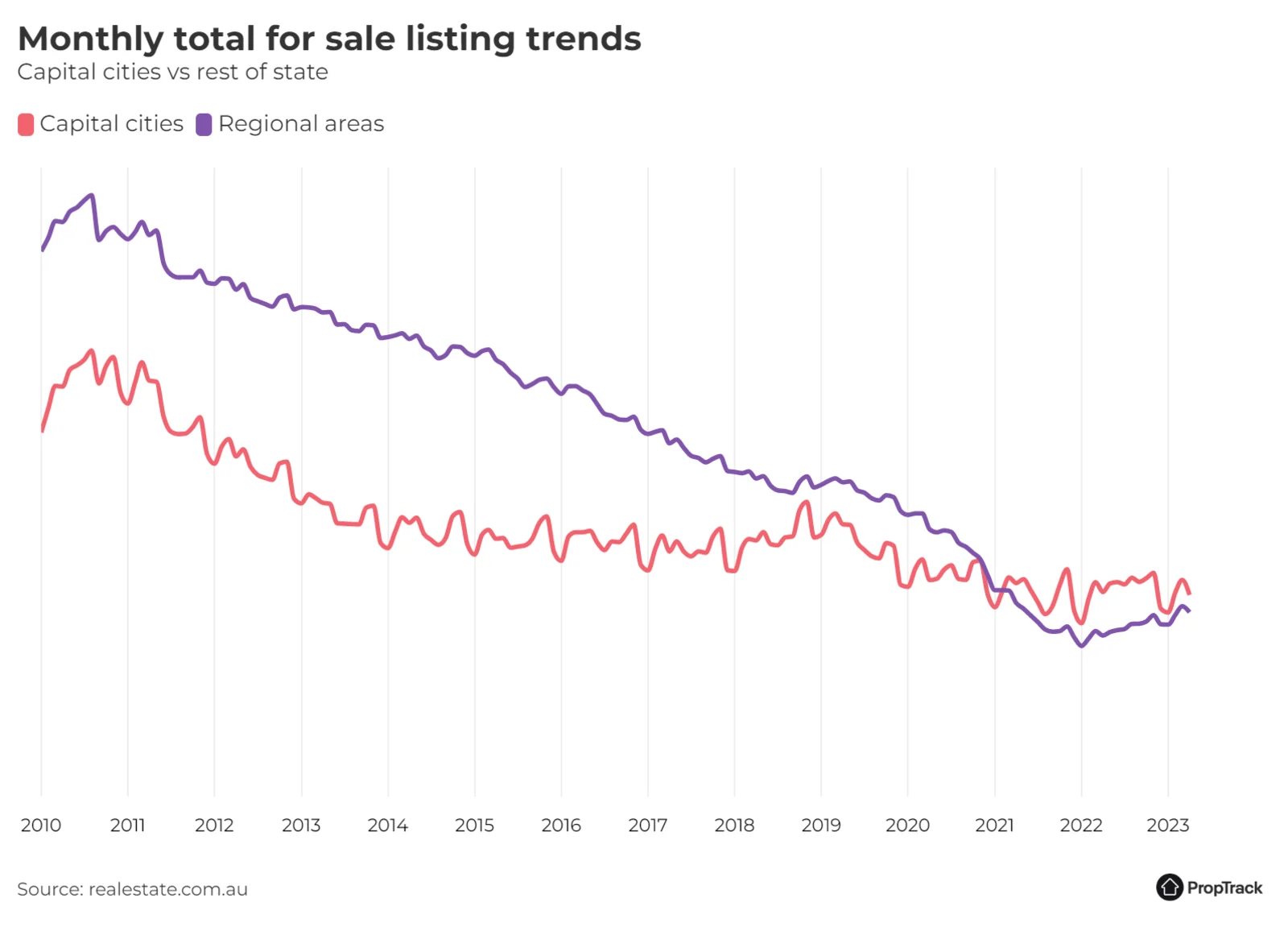

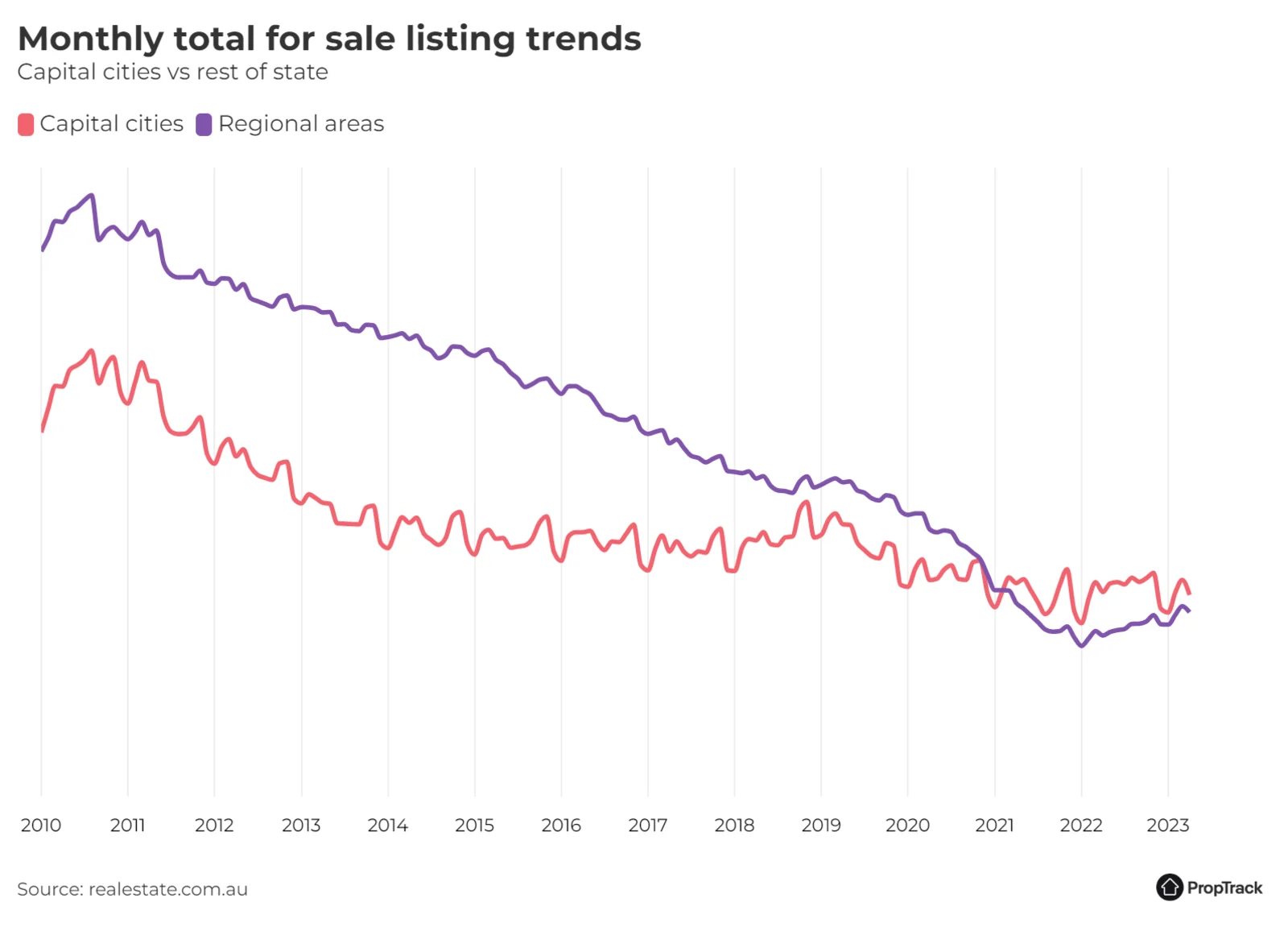

Although it was a slower month of new listings, the total number of properties available for sale has improved compared to a year ago, and compared to the low levels seen during 2021, which is helping give buyers more choice. This is particularly true in some regional areas, where choice was extremely limited during the pandemic.

This monthly report analyses new and total listings on realestate.com.au to provide the most up-to-date view on property market supply trends.

Executive summary

April was a quieter month than March across the nation’s property markets, as is usually the case due to the Easter and Anzac Day public holidays. While April is usually a quieter month, this year saw slower market conditions than was the case in 2022. This is consistent with the trend in slower activity throughout the start of 2023, relative to 2022.

Nationally, new listings on realestate.com.au decreased 28.3% month-on-month.

Compared to last year, new listings were down 23.5% in April.

The slower month was seen across the capital cities, with all cities seeing new listings down around a quarter to a third compared to March. In sum across the capital cities, new listings were down 29% month-on-month.

All capitals also recorded fewer new listings compared to a year ago, with new listings in the combined capital cities down just under a quarter year-on-year (-24.9%). While a notable decline, it in part reflects the busy pace of activity seen in early 2022.

Both Sydney and Melbourne recorded around a quarter fewer new listings this April compared to last year (down 24.9% and 22.5%, respectively). Darwin and Adelaide recorded the smallest year-on-year declines, but both still saw new listings down around one-sixth compared to a year ago.

Regional areas also saw new listings decrease in April, down 27.2% month-on-month. As with capital cities, 2023 has not kept pace with the busy mark set in 2022, and new listings in April were 21.4% lower than a year ago.

The slower month of new listings meant choice for buyers declined a little in April (as measured by the total number of properties available for sale). Even so, choice has improved compared to a year ago, and compared to the low levels seen during 2021. This is particularly true in regional Victoria and regional NSW.

While the total number of properties listed for sale declined in the month in both Sydney and Melbourne, both remain above their pre-pandemic level. And in Melbourne, the total number of properties listed for sale was above the average over the past decade. In Sydney it slipped a little below after being above-average last month.

Hobart has seen an extremely sharp increase in the total number of properties listed for sale, with 66.9% more properties for sale compared to a year ago. There are more properties listed for sale in Hobart than at any time since 2017 (aside from last month, which was higher again).

The total stock of properties listed for sale has been improving in some regional areas, especially regional NSW, Victoria, and Tasmania. While the total number of properties listed for sale in these areas is still below its pre-pandemic level, it has improved markedly over the past year. In other regional areas, the number of properties available for sale is still lower than a year ago.

Where to from here?

Property markets have had a quieter start to the year than was the case in 2022. That slowdown comes after an extremely busy period in early 2022. With the majority of the autumn selling season now behind us, we expect market activity will remain quieter over the next few months, as it usually does heading into, and during, the quieter winter period before picking up again for spring.

Home prices continued to increase slightly in April for the fourth consecutive month. While the increases have been modest, it is a change from the consistent price falls seen throughout much of 2022 when the RBA was raising interest rates very quickly.

While selling conditions are softer than a year ago, and market activity has slowed, market conditions have improved from late 2022. Auction clearance rates have remained reasonably firm through autumn, and have picked up compared to the second half of 2022.

While selling conditions are softer than a year ago, and market activity has slowed, market conditions have improved from late 2022. Auction clearance rates have remained reasonably firm through autumn, and have picked up compared to the second half of 2022. Further out, the fundamentals of housing demand remain strong. Unemployment has remained close to multi-decade lows for much of 2022 and into 2023. Wages growth, while running slower than inflation, has started to pick up. International migration has also resumed, which will further add to housing demand. And rental markets are extremely tight across the country.

Methodology

The ‘PropTrack Listings Report’ details monthly changes in the number of properties listed for sale on realestate.com.au. The listings are split into ‘new’ and ‘total’ listings.

New listings consist of properties that were newly listed for sale on realestate.com.au within the reported month.

Total listings is the total supply of properties for sale in the reported month. It consists of all listings which were for sale during that month (including new listings) irrespective of the date they first appeared on site.

The geographical areas described in this report are based on the Greater Capital City Statistical Area (GCCSA) as defined by the Australian Bureau of Statistics.

Disclaimer: PropTrack Listings Report is summary information only. realestate.com.au Pty Limited [REA] makes no representation whatsoever about PropTrack Listings Report’s completeness or accuracy. REA is under no obligation to update or correct any of the PropTrack Listings Report data or to continue to make the PropTrack Listings Report available. REA recommends that any users of the PropTrack Listings Report exercise their own skill and care with respect to their use of the PropTrack Listings Report and that users carefully evaluate the accuracy, currency, completeness and relevance of the PropTrack Listings Report for their purposes. REA expressly bears no responsibility, and accepts no liability, whatsoever for any reliance placed by you or others on the PropTrack Listings Report, or from any use of the PropTrack Listings Report by you or others. If you wish to cite or refer to this report (or any findings or data contained in it) in any publication, please refer to the report as the ‘PropTrack Listings Report – April 2023′.

Learn more